Stop Creditors from Calling. File a Consumer Proposal in Alberta.

Rebuild your life with debt solutions that put your needs first.

A consumer proposal can help you pay down your debt with less stress. Work with our Licensed Insolvency Trustees (LIT), who provide immediate protection from creditor proceedings, while counselling your way back to a peaceful life with a sound consumer debt proposal.

Request a Free ConsultationA consumer proposal legally binds you and your creditors into a renegotiated debt repayment plan. With a Faber LIT on your side, you will pay a portion of your total unsecured debt over five years, with zero interest on your principal.

Under the Bankruptcy and Insolvency Act, a consumer proposal is administered to protect you from adverse creditor action, which may further endanger your ability to pay back your debt.

With Faber’s certified financial debt experts and Licensed Insolvency Trustees (LITs), we can actively manage your debt by reviewing your finances in a non-judgmental and bias-free environment.

If the last 25+ years of debt service management has taught us anything, it is to personalise your debt strategy to get you out of debt and empower you with the confidence to reclaim your life after debt.

With a Faber LIT on your side, you get a fresh financial start and so do your creditors, a lot easier and earlier.

Main Advantages of a Consumer Proposal

- As opposed to personal bankruptcy, your monthly debt payment is fixed.

- You can either pay all or a portion of your unsecured debts over a maximum period of five years.

- Once the consumer proposal is filed, an immediate stay is placed on all creditor legal action, including the Canadian Revenue Agency and other collections agencies.

- With the court order, you’ll stop receiving phone calls and wage garnishment will be suspended.

- If your bank account or assets have been seized, those seizures will terminate immediately.

While a consumer proposal can give you relief in many ways, it may not always be the right option. Those who owe debt between $1,000 and $250,000 are eligible to file a consumer proposal in Alberta.

The $250,000 threshold limit won’t include your home mortgage, in which case filing for personal bankruptcy is recommended.

Why a Consumer Proposal Might Work For You

While a consumer proposal is a great option for some consumers, it’s also not the only debt relief option there is out there. Many for-profit debt solutions companies have resorted to pocketing off unsuspecting consumers for whom filing a consumer proposal may not be the best option.

You have the right to walk away from situations that pressure you to pay thousands of dollars even before a consumer proposal is filed.

Our Licensed Insolvency Trustees are both trained in judicial filing processes and sound financial planning. In your first confidential session (at no cost) with a LIT, we plan your debt strategy with what you are comfortable with in order to reclaim your financial independence.

We call the active management of your debt a path to “greater financial recovery.”

When we use the term “greater financial recovery,” it could include one or more of the following:

- a one-time lump sum payment

- distributing payments to your unsecured creditors more frequently than in a bankruptcy

- reduced administration fees

- paying more into the consumer proposal on a monthly basis or for a longer period of time than would be required in a personal bankruptcy

Process for Consumer Proposal Filing

A consumer proposal must be made through a federally regulated Licensed Insolvency Trustee who is known as the Proposal Administrator. The Proposal Administrator will file your consumer proposal and send notice to your unsecured creditors.

They will respond with a voting letter to either accept or reject your consumer proposal. If the unsecured creditors vote to accept your consumer proposal by a simple majority (50% or more) and the court approves it, your consumer proposal becomes a binding legal contract. It applies to all your unsecured creditors, even if some of them voted to reject your consumer proposal or did not vote at all.

Fortunately, unsecured creditors are more likely to accept consumer proposals, as they know they will receive a “greater financial recovery” from your consumer proposal than they will receive from personal bankruptcy.

If the unsecured creditors vote to reject your consumer proposal, we will go over the next best debt recovery option that will improve your finances.

Insights on Consumer Proposals

Have Additional Questions About Consumer Proposals?

If you’re earning income from a single or multiple sources and still struggle with paying off your debt, you may want to know how it impacts your overall credit rating, debt situation, and future financial goals. Our seasoned Licensed Insolvency Trustees (LITs) have put together years of experience behind responding to commonly asked questions about filing a consumer proposal versus considering other debt management alternatives.

According to the law, consumer proposals can last from one to five years. Since debt situations vary depending on the size and nature of debt owed, the duration it takes to complete a consumer proposal isn’t and cannot be standardized across all types of debts.

To be fair to all parties involved, a reasonable size of your debt is to be paid. Generally, you can have your debt reduced by up to 70% if all parties agree. However, a good rule of thumb is to pay back an agreeable portion of your debt while also considering your ability to manage your living expenses as you go.

It is hard to get approved for a credit card when you file a consumer proposal. However, you may be able to use a prepaid secured credit card.

Equifax and TransUnion remove a consumer proposal from your credit record three years from the date you’ve paid off your debt or six years from the date your proposal was filed, whichever comes first.

When you fall behind on three monthly payments or by three months on one payment if you’re on a bi-annual or quarterly payment plan, your consumer proposal terms are immediately annulled and interests, penalties, or creditor-imposed terms are restored.

Where Do I File A Consumer Proposal? Book Your No-Obligation Confidential Consultation With a Faber LIT.

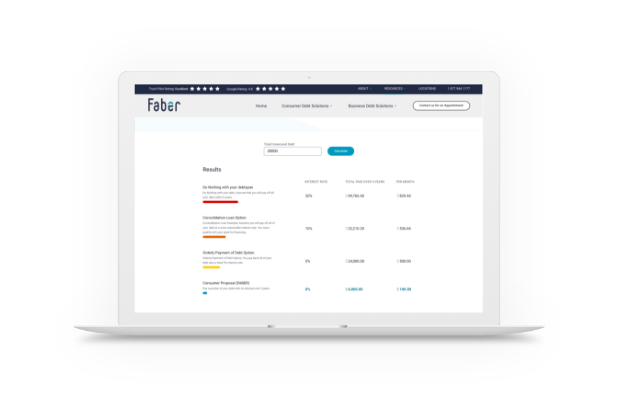

Beyond consumer proposals, there are other debt recovery options that may better fit your situation.

Get your free debt consultation by calling us at 1-888-527-8999 or at +1 844 651 1350 toll-free in Alberta.

Get in touch with a Faber LIT